Zerodha Mutual Fund Gold ETF: Investing in gold on Dhanteras and Diwali is an old tradition in India. Every year millions of people invest in gold on this occasion, considering it not only as a cultural heritage but also as a safe investment. Keeping this in mind, Zerodha Mutual Fund has introduced a new fund offer (NFO) of Gold ETF FoF (Fund of Funds). This NFO will be open for subscription from October 25 to November 8, 2024.

This fund offers investors the opportunity for capital growth through gold ETFs, allowing investors to profit from the gold market without owning physical gold. Let us understand the key features and pros and cons of this NFO in detail.

Key Features of Zerodha Mutual Fund Gold ETF

Zerodha’s Gold ETF FoF is an open-ended fund that invests exclusively in gold ETFs. Thus, the fund does not invest in physical gold itself but invests in exchange traded funds (ETFs) that invest in gold. The advantage is that investors can participate in the gold market without the hassle of safety and storage of physical gold. The fund is benchmarked to the domestic price of physical gold, allowing the investor to benefit from the appreciation in gold.

Important information about Zerodha Mutual Fund Gold ETF

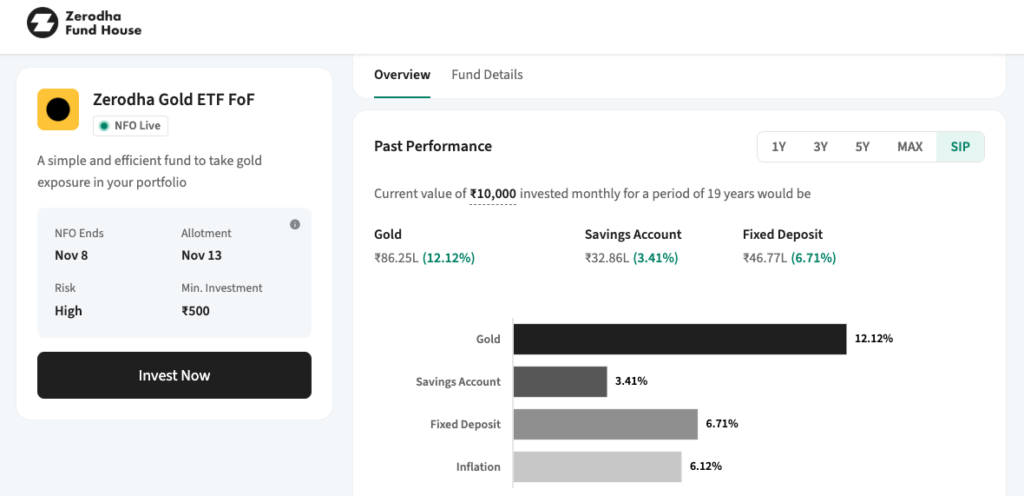

- NFO opening date: 25 October 2024

- NFO closing date: 8 November 2024

- Minimum investment amount: Rs 500

- Minimum SIP amount: Rs 500 per month

- Expense ratio: Maximum 1% (as per SEBI norms)

The objective of this scheme is long-term capital appreciation. The investment structure of the fund is based on investing 95-100% of the funds in gold ETFs and the remaining 0-5% in debt securities and money market instruments. This is a passive investment strategy fund that continues to invest in gold ETFs irrespective of the fluctuation in gold prices.

Key Benefits of Investing in Zerodha Gold ETF FoF

Safe and easy investment in gold

The biggest advantage of this NFO is that it is an easy and safe way for investors who want to invest in gold but want to avoid the challenges of buying and storing physical gold. Through this fund, investors can directly become a part of the gold market, which provides transparency and security in investment.

Protection from inflation

Gold is considered an “inflation-protected” asset, which can provide stability to the portfolio in difficult times. Investing in gold can prove to be a safe option in times of economic instability and inflation. Gold ETFs are helpful in balancing the effect of inflation, which you can easily do through this fund.

Stability and diversity in portfolio

Gold has a low correlation with the stock market, so it can help reduce the volatility of your portfolio. At a time when the stock market may fall, the stability of gold can balance your portfolio. For this reason, gold ETFs can be a good option to bring diversity and stability to your portfolio.

Small and regular investment facility (SIP)

A big attraction of this fund is that you can also invest in it through SIP, the minimum amount of which is only Rs 500 per month. This is beneficial for those who do not want to make a big investment at once but want to gradually invest in gold from their savings. This facility encourages disciplined investing for the long term.

Potential risks of investing in this NFO

Every investment has some risk associated with it, and investors in Zerodha’s Gold ETF FoF may also face some challenges.

Volatility in Gold Prices:

Gold prices fluctuate from time to time. Gold prices keep changing based on global economic conditions, currency fluctuations, and other factors. Investors should be prepared for this volatility, especially when they are investing in the short term.

High Risk Level:

This fund falls in the high risk category. Hence, only those who can handle higher risk in their portfolio should invest in it. Gold ETFs are generally relatively safe, but still have risk, considering they are less volatile than equities.

Long Term Focus Required:

The real benefit of investing in gold is in the long term. Gold prices are more volatile in the short term, while this volatility may be less in the long term. Hence, this NFO is suitable for investors who are planning to invest for the long term.

Is Zerodha Gold ETF FoF the right choice for you?

If you are planning to invest in gold and want to avoid the hassles associated with physical gold, then Zerodha Gold ETF FoF can be a better option for you. This fund gives you the experience of investing in gold but without the worries of storage and security.

The traditional significance of investing in gold on Dhanteras and Diwali, this fund retains the same spirit but with modern investment techniques. Through this fund, you can easily invest in gold and bring stability to your portfolio. However, keep in mind that the risk level of this fund is ‘high’, and it is important to adopt it with a sensible investment plan.

If you want capital growth in the long term and are ready to take high risk, then Zerodha Mutual Fund’s Gold ETF FoF can become a safe and profitable option in your investment portfolio this Dhanteras.